CEO UPDATES ARCHIVE

Past Updates From President & Chief Executive Officer Scott A. Wilson

Browse through our archive to find content from the past pertaining to SeaComm President & CEO, Scott A. Wilson, and the credit union. Here you will find his videos, interviews, and messages to the membership.

View the list of topics below and click on any of them to expand the article.

Looking for podcasts? Find them here.

Articles:

Report of the President & Chief Executive Officer

As we move well into the third quarter, SeaComm continues to be on target to meet our expected forecast set forth in the FY23 board-approved operating budget. Member satisfaction, staff engagement and overall profitability continues to remain above expectation.

Our Financial Position Today Continues to Remain Solid

Net income as of July 31, 2023 was $4,620,255. Our net assets at the end of July were $800,827,770. At the same time, net operating expenses YTD were 1.93%, well below the 3% targeted goal set by the credit union’s budget. However, dividend expense is up more than $887,000 compared to budget. Today, we have $109 million in unrealized earnings. Capital remains a key component to our financial health, as it is necessary to grow adequate reserves so we are able to withstand any uncertainty as our assets continue to increase and thereby be viable well into the future. As a large financially complex credit union, we are required to maintain a risk-based capital ratio at minimum of 10%. Today, we stand at 24.67%, well above what is required.

Bauer Financial, another independent rating company, awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements.

Bauer Financial, another independent rating company, awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements.

Weiss, an independent rating agency rated us with a B rating as of Q1FY23. This means we offer good financial security and we have the resources to deal with a variety of adverse economic conditions. We comfortably exceed the minimum levels for all of our rating criteria, and are likely to remain healthy for the near future.

Annual Meeting

In my report at this year’s annual meeting held in May, we were able to announce 2022 was another solid year for SeaComm. Highlights for the previous year, which included: earnings exceeding budget, membership growth at 3 percent, continued increase market share penetration with our newest location in Watertown, NY, as well as a solid year for our SeaComm Personal Advisor Services with over $72 million of assets under management. We also saw an increase in our mobile technology usage with a growth of 24%. Member satisfaction remained consistently high with an overall quality loop score of 6.81 out of 7. The overall message we relayed was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model at any point it is needed. Three Directors were elected to 3-year terms. And, the Board re-appointed the current members of the Supervisory Committee to an additional one-year term. A podcast recapping the 2022 meeting is available on our website.

In my report at this year’s annual meeting held in May, we were able to announce 2022 was another solid year for SeaComm. Highlights for the previous year, which included: earnings exceeding budget, membership growth at 3 percent, continued increase market share penetration with our newest location in Watertown, NY, as well as a solid year for our SeaComm Personal Advisor Services with over $72 million of assets under management. We also saw an increase in our mobile technology usage with a growth of 24%. Member satisfaction remained consistently high with an overall quality loop score of 6.81 out of 7. The overall message we relayed was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model at any point it is needed. Three Directors were elected to 3-year terms. And, the Board re-appointed the current members of the Supervisory Committee to an additional one-year term. A podcast recapping the 2022 meeting is available on our website.

St. Lawrence FCU Merger

The proposed merger with St. Lawrence Federal Credit Union concluded during a special meeting held on August 28, 2023, with SLFCU members voting against the merger.

We are disappointed with the final outcome of the membership vote. SeaComm wishes the membership and staff of St. Lawrence all its best. We extend our gratitude to the senior management team of St. Lawrence who worked hand in hand with us to try and make this merger happen. SeaComm will move forward on a separate path and continue to offer the very best value to our membership, staff and the communities in which we serve. Also, in the cooperative spirit of the credit union movement, we have and will continue to have a good relationship with St. Lawrence.

“Although disappointed with the outcome, SeaComm’s Board of Directors will continue to ensure we move forward strategically, by focusing on our nearly 54,000 members with the same high-touch, exceptional service and diverse product and service offering they have come to know and expect from us,” states SeaComm Board Chairman Myron Burns.

Earlier this year, our employees were able to participate in our annual employee engagement survey process through Great Place to Work. This is the 11th consecutive year. We were very happy to report that after we received the results, 90% of our employees say that overall SeaComm is a great place to work. Some of what we learned is that 96% felt good about the way we contribute to the community; 95% stated that management is honest and ethical in its business practices; 96% agree that management is competent at running the business; 95% say when you join the company, you are made to feel welcome and 93% say they are proud to tell others they work for SeaComm. We are extremely proud to be included within this privileged group across the country. We held a special recognition day on June 13th for all staff, whereby they could enter to win prizes, wear jeans, receive a gift bag and have lunch on the credit union.

Earlier this year, our employees were able to participate in our annual employee engagement survey process through Great Place to Work. This is the 11th consecutive year. We were very happy to report that after we received the results, 90% of our employees say that overall SeaComm is a great place to work. Some of what we learned is that 96% felt good about the way we contribute to the community; 95% stated that management is honest and ethical in its business practices; 96% agree that management is competent at running the business; 95% say when you join the company, you are made to feel welcome and 93% say they are proud to tell others they work for SeaComm. We are extremely proud to be included within this privileged group across the country. We held a special recognition day on June 13th for all staff, whereby they could enter to win prizes, wear jeans, receive a gift bag and have lunch on the credit union.

As we continue celebrating our 60th anniversary, we will be focusing our attention on ensuring that every interaction with our membership exceeds expectation. This focus continues to meet the ever-changing business landscape and provide each member with a strong value proposition in being a member of our credit union. This is done through a consistent and responsible growth strategy.

As we continue celebrating our 60th anniversary, we will be focusing our attention on ensuring that every interaction with our membership exceeds expectation. This focus continues to meet the ever-changing business landscape and provide each member with a strong value proposition in being a member of our credit union. This is done through a consistent and responsible growth strategy.

On behalf of the Board of Directors, management and staff, we are grateful to our nearly 53,780 members who have put their trust in us and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Report of the President & Chief Executive Officer

Sixty Years and Counting: We Are Still Committed to Our Roots

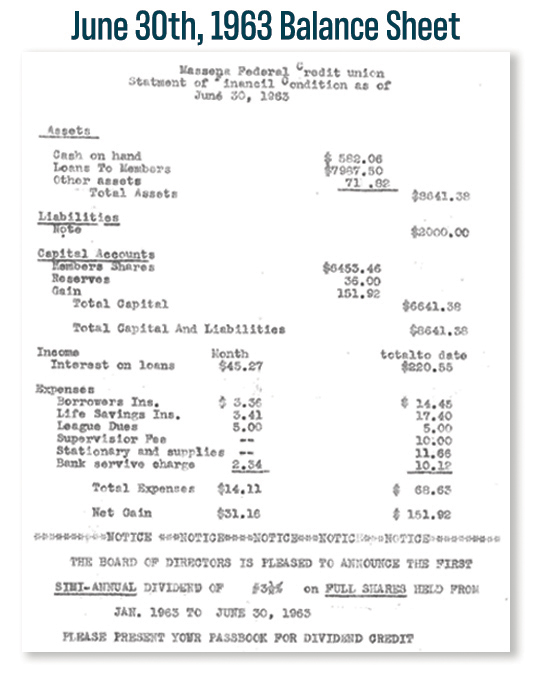

SeaComm will celebrate its 60th anniversary on June 6, 2023. This milestone provides us a concrete way to look back and appreciate all of the hard work and dedication that has been accomplished since those early days.

It all started with a tool box (which is iconic for us today and can be seen in the lobbies of all our branches), $50 and a shared vision of then ten Chevrolet Foundry workers, who each wanted to improve the financial lives of not only themselves, but also their coworkers. Although our assets have grown from $8,641.38 to $775 million December 31, 2022, that vision is no less important today than it was back on June 6, 1963.

The ten men who signed our charter of incorporation were James G. Capell, Paul R. Catlin, James R. Ellis, Harold H. Guile, Earl M. Jackson, Carl L. MacDonald, Darrell Mills, Max M. Ryan, Frank E. Sequin and John Zakarauskas. Earl Jackson, the remaining charter member, is still an active member of the Credit Union today. He reminds me when we speak about those early days, how SeaComm has become so very much more than they had ever dreamed.

The ten men who signed our charter of incorporation were James G. Capell, Paul R. Catlin, James R. Ellis, Harold H. Guile, Earl M. Jackson, Carl L. MacDonald, Darrell Mills, Max M. Ryan, Frank E. Sequin and John Zakarauskas. Earl Jackson, the remaining charter member, is still an active member of the Credit Union today. He reminds me when we speak about those early days, how SeaComm has become so very much more than they had ever dreamed.

Even though the name has changed a number of times since the signing of the charter, that is a great testament to all those who have built upon the very foundation which he and those other men believed in.

This past fall, we lost our long-time Board Secretary, Gary B. Fuller, who served as a volunteer of the Credit Union from day one. In 2018 as part of our 55th anniversary celebration, the Board of Directors approved the naming of the SeaComm headquarters boardroom in honor of his dedicated service. His contributions to the growth of the credit union and his unwavering dedicated support made possible where we are today.  He had been at the governance level from day one and, for nearly six decades, had proven himself as a guiding influence to ensure the credit union stayed true to its mission of taking care of people. Now this room stands in memory of him. He is gone, but will never be forgotten.

He had been at the governance level from day one and, for nearly six decades, had proven himself as a guiding influence to ensure the credit union stayed true to its mission of taking care of people. Now this room stands in memory of him. He is gone, but will never be forgotten.

This past December, we celebrated the opening of our newest retail branch in Watertown, NY, and I had remarked at the grand opening even though, we no longer have that physical reminder of a GM plant in operation, it is no less important.

Today, we reflect on our Credit Union’s history, as well as its future path through the most recent expansions into the counties of Clinton and Essex in NY, Grand Isle, Franklin and Chittenden in Vermont and most recently west into Jefferson and Lewis Counties, NY. As we continue to evolve and build upon the vision those employees at GM dreamed about, staying true to “People Helping People” we are truly humbled in what they decided to start building all those years ago. I know they would all be proud of what we have become and continue to do for our membership and the communities in which we do business.

Our Financial Position Today Continues to Remain Solid

Our financial position continues to remain solid. Year-end assets climbed in excess of $775 million. At the same time, our net operating expenses YTD ended at 1.80%, well below our goal of 3%. We finished the year with a net income of $7.2 million, garnering us more than $105 million in undivided earnings. Capital remains a key component to our financial health as it is necessary to maintain adequate financial reserves for potential loan losses and investments in our physical and technological infrastructure as our assets continue to grow. It ensures that we are able to withstand any economic uncertainty. Our risk-based capital of 25.11% is well above the 10% regulatory requirement.

Our financial strength continues to be nationally recognized. Weiss Ratings, the nation’s leading independent provider of ratings and analyses of more than 19,000 financial institutions, including banks, credit unions, life and annuity insurers, and property and casualty insurers, gave us an “A-” rating. A ranking of “A-” is considered excellent, meaning SeaComm offers excellent financial security. SeaComm maintains a conservative stance in its business operations as evidenced by their strong equity base, superior asset quality, steady earnings and high liquidity. Weiss goes on to state that SeaComm has the resources necessary to deal with severe economic conditions. SeaComm is among an elite group of 614 credit unions nationwide representing the top 13% of the industry.

Our financial strength continues to be nationally recognized. Weiss Ratings, the nation’s leading independent provider of ratings and analyses of more than 19,000 financial institutions, including banks, credit unions, life and annuity insurers, and property and casualty insurers, gave us an “A-” rating. A ranking of “A-” is considered excellent, meaning SeaComm offers excellent financial security. SeaComm maintains a conservative stance in its business operations as evidenced by their strong equity base, superior asset quality, steady earnings and high liquidity. Weiss goes on to state that SeaComm has the resources necessary to deal with severe economic conditions. SeaComm is among an elite group of 614 credit unions nationwide representing the top 13% of the industry.

Bauer Financial, an independent financial rating company, recently awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

Bauer Financial, an independent financial rating company, recently awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

Exceptional Service Is Our Top Priority

Service is a strategic goal set by our Board of Directors and one we work to exceed each and every day. One of the ways we gauge how we are doing is the use of our Quality Loop Survey. On a monthly basis, these random surveys are sent out to members who have conducted some sort of transaction at the Credit Union. This can be as simple as a balance inquiry to applying for a loan. Whatever the circumstance, we want feedback on how the member was treated and if we did everything necessary to make them feel valued. Scores range from 1 to 7. Our overall result for 2022 was 6.81.

At the end of each year, we calculate the overall average of every employee who received surveys on their delivery of service both externally and internally. The top ten are given the President’s Award for Service Excellence.

In 2022 they were:

Rose LaPoint-Matthews, Senior Teller, Canton Branch

Taylor Thrasher, CCR, Call Center

Stephenie Curran, CCR, Call Center

Cherie Murray, Teller, Stearns Street Branch

Laurie French, Teller, Plattsburgh Branch

Tabitha Ladison, Team Lead, Payment Operations

Donna Deruchia, Call Center Manager

Sarah Mitchell, AVP, Risk Department

Melissa Cree, Core Specialist I, Information Systems

Neary McCarthy, Accounting Specialist

This is the 10th year in a row for Rose LaPoint-Matthews, of our Canton Branch, who has been consistently at the top for providing exceptional service. We are extremely proud of these individuals and the work all of our employees perform routinely in delivering remarkable member service

For the third time, a branch was given an award for the top Quality Loop overall average. This year, the Ogdensburg Branch, with an overall score of 6.93 out of a possible 7, collected the top honor. Congratulations to Liz LeValley, Branch Manager and her entire team.

What Can We Expect to Happen Next?

We are pleased to announce that we have signed an agreement with St. Lawrence FCU, Ogdensburg, NY, to merge into us. In an effort to move this forward, we have been working with their CEO Todd Mashaw and Board of Directors since last fall.  Both Boards of Directors voted to approve the merger. We have completed a rigorous due diligence process. The merger will require regulatory approval and a St. Lawrence member vote which is expected to take place this summer.

Both Boards of Directors voted to approve the merger. We have completed a rigorous due diligence process. The merger will require regulatory approval and a St. Lawrence member vote which is expected to take place this summer.

Under the terms of the agreement, one (1) St. Lawrence Board Director will join the SeaComm Board. There will also be a three person advisory committee formed from the current St. Lawrence Board to provide advice and counsel on the overall effect of the merger.

St. Lawrence’s mission and values are succinctly aligned with ours and we will only strengthen us even more as we move forward together. We will continue to keep you updated as the process progresses.

On behalf of the Board of Directors, management and staff I would like to thank our 52,977 members who have made SeaComm what it is today and for allowing us to continue to serve your financial needs for nearly six decades.

We look forward to working together well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Report of the President & Chief Executive Officer

This month marks my fifteenth-year anniversary as Chief Executive Officer.  Taking this opportunity to reflect on the decade and a half, I am humbled to be leading an organization that has never forgotten its roots. During the height of the “Great Recession”, SeaComm was able to navigate through some of the most tumultuous times economically that our country has experienced since the “Great Depression.” Bank and credit union failures, the bankruptcy of General Motors, thousands of good workers displaced through unemployment and foreclosures of homes were regular fodder on the nightly news. Most recently, a global pandemic, which put not only our economy on pause, but also our personal lives as well. That uncertainly put undue stress on all of us.

Taking this opportunity to reflect on the decade and a half, I am humbled to be leading an organization that has never forgotten its roots. During the height of the “Great Recession”, SeaComm was able to navigate through some of the most tumultuous times economically that our country has experienced since the “Great Depression.” Bank and credit union failures, the bankruptcy of General Motors, thousands of good workers displaced through unemployment and foreclosures of homes were regular fodder on the nightly news. Most recently, a global pandemic, which put not only our economy on pause, but also our personal lives as well. That uncertainly put undue stress on all of us.

During those two major events, SeaComm was a beacon of hope for so many. We didn’t adversely affect our members by rescoring our credit card portfolio, reduce lending to small businesses, moreover, we assisted as a Payroll Protection lender guaranteed by the SBA and we did not increase our fees to offset the loss of interest income due to the low interest rate environment set by the Federal Reserve. In fact, we kept our deposit rates among the highest in our market during both environmental cycles. We ensured that we stayed true to what the 1934 Credit Union Act was all about. We continued to ensure we were making credit available to those who needed it and ensured that we did it in a safe and prudent manner.

We continue to make progress in growing our products, services and footprint. Most recently with our merger with United Neighbors in Watertown, we have expanded our reach into Jefferson County. All while we are meeting our key operating goals and maintaining an overall strong balance sheet. Although not our intended mission, it does continue to be extremely important to our long-term financial well-being. The heart of why we exist comes from us improving the overall financial lives of the member, which begins from the moment they open that door and enter a branch, make that phone call or send that email. As a cooperative financial institution, missioned with helping one another, whether it is borrowing or placing funds on deposit, we are here to help one another.

As the economic climate continues to change, we remain committed to being there for any type of financial situation. We understand that no members’ financial life fits into a “one-size-fits-all” box and therefore shouldn’t be reduced to just a FICO credit score. The relationship we enjoy with our members isn’t just about the one-time car loan; it’s about the entire lifelong relationship. We are committed to being there – when our members need us the most.

There are numerous highlights of my career at SeaComm which I could share. The one I am most proud of, was being able to save a family who faced losing their home through foreclosure by a larger financial institution. In a letter of appreciation, these members wrote, “After the loss of my job, the faceless individuals called us losers and were going to take our home. With no other options, we went to see you. I have never heard of an individual going to the President of a banking institution and asking for help. But, you Mr. Wilson, President of SeaComm, did meet with us and because of your compassion and understanding, made it possible for us to keep our home.”

We help so many with auto loans to get that needed car to get to work, fulfilling a dream of home ownership and even personal loans to help with Christmas or those badly needed tires for the car. Whatever the need, we are willing to take a look and hopefully assist in any way we can. These successes come in many forms. A member sent this message to me recently, which highlights the impact we have on our members’ lives, “I am reaching out to you today to tell you about a great experience. I went through a bankruptcy a few years ago, never excepting to return to SeaComm. The staff made my returning back to SeaComm a great experience. And extremely comfortable!! Once again a very happy member.”

Given this opportunity by the Board of Directors to lead SeaComm has been a pinnacle of my professional career. A day never goes by that I am not personally appreciative of the hard-working, talented staff who ensure our members are taken care of every single day, the Board of Directors, who dedicate their time and talent to ensure our mission of doing the right thing of enhancing our members’ financial lives is fulfilled.

As we move well into the third quarter, SeaComm continues to be on target to meet our expected forecast set forth in the FY2022 operating budget.

Our Financial Position Today Continues to Remain Solid

Net income as of July 31, 2022 is $4.2 million. Our net assets at the end of July were $767 million. That’s a growth of more than $21 million from the previous year. At the same time, net operating expenses YTD were 1.68%, well below the 3.0% targeted goal set by the credit union’s budget. Today, we have $102.4 million in undivided earnings. Capital remains a key component to our financial health as it is necessary to grow adequate reserves so we are able to withstand any uncertainty as our assets continue to increase and thereby be viable well into the future. As of January 1, 2022 as a large financially complex credit union, we are required to maintain a risk-based capital ratio at minimum of 10%. Today, we stand at 26.36%, well above what is required.

Weiss, an independent rating agency, has once again provided SeaComm the A rating in terms of excellent financial strength. BauerFinancial, another independent rating company, awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements. DepositAccounts also gave us an A+ rating for FY22; one of the highest health grades given out and placing us in the top 200 healthiest credit unions in the U.S in 2021.

Annual Meeting

In my report at this year’s annual meeting in May, we were pleased to announce that 2021 was another exceptional year for SeaComm. Highlights for the previous year, included: continued membership growth at 4% as well as a solid growth for lending. Member satisfaction, staff engagement and overall profitability remained high. The overall message relayed was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model. Two directors were elected to 3-year terms, Patricia Dodge and Thomas Hannan. A podcast recapping the meeting is available on our website.

Other highlights include:

- Certified as a Great Place to Work

- Opened our second retail branch in Vermont

- A clean audit opinion by our external auditors Nearman, Maynard, Vallez, CPAs

As we move forward, we are excited about our newest branch in Watertown. This new location will offer our members in that market additional services, such as a drive-thru and ATM, which has not been available at our current location. The project is expected to be complete sometime later this fall.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 52,450 members, who continue to put their trust in us, and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Report from the President & Chief Executive Officer

Exceptional Service is Our Top Priority

Service is a strategic goal set by our Board of Directors and one we work to exceed each and every day. One of the ways we gauge how we are doing is the use of our Quality Loop Survey. On a monthly basis, these random surveys are sent out to members who have conducted some sort of transaction at the Credit Union. This can be as simple as a balance inquiry to applying for a loan. Whatever the circumstance, we want feedback on how the member was treated and if we did everything necessary to make them feel valued. Scores range from 1 to 7. Our overall result for 2021 was 6.81.

At the end of each year, we calculate the overall average of every employee who received surveys on their delivery of service both externally and internally. The top ten are given the President’s Award for Service Excellence. In 2021 they were:

- Rose LaPoint-Matthews, Senior Teller, Canton Branch

- Lily Pomainville, FSA, Canton Branch

- MacKenzie Perkins, FSR/Teller, Stearns Street Branch

- Carla Mitchell, Senior Teller, Malone Branch

- Vanessa Planty, CCR, Call Center

- Katie Seidel, Payment Operations Representative, Payment Operations

- Noah McCarthy, Help Desk Technician, Information Systems

- Audra LaShomb, EFT/ACH Specialist, Payment Operations

- Maggie Wilkins, Payment Operations Manager

- Ashley Conway, Lending Operations Representative, Risk Management

This is the ninth year in a row for Rose LaPoint-Matthews of our Canton Branch, who has been consistently at the top for exceptional service. We are extremely proud of these individuals and the work all of our employees perform with their consistency in delivering exceptional member service.

For the second time, a branch was given an award for the top Quality Loop overall average. This was a new category in 2020 and was awarded to our Plattsburgh Branch that year. This year, the Canton Branch with an overall score of 6.92 out of 7 took the top honor. Congratulations to Barb Bessette, Branch Manager and her entire team.

We are extremely proud of all these individuals and the work all of our employees perform and their consistency in delivering exceptional member service. All were recognized for their high achievement in this area with their names on a permanent plaque, an appreciation certificate, gift and a lunch.

Keeping Engaged with Staff is Key

We absolutely know why SeaComm is so successful. We have a talented, smart, hard-working staff, which takes great pride in their work of serving our members. We do have high expectations and are committed to maintaining that standard, moreover, we are incredibly fortunate to have dedicated employees who live our service values.

To ensure we are keeping engaged with our staff, we have participated for the last eleven years with an employee engagement survey. For the first ten, Best Companies to Work for in NY and most recently the Great Place to Work. The feedback, which is provided by our staff, give us the ability to talk about areas, whereby as an employer we can improve, whether it is in the area of training, benefits or communication. This is an ongoing dialogue that occurs between each survey, amongst our staff, managers, senior management and board.

Financial Strength

Our financial position continues to remain solid. Year-end assets climbed in excess of $759 million, an annual growth of 13% from year-end December 31, 2020. At the same time, our net operating expenses YTD were at 1.53%, well below our goal of 3%. We finished the year with a net income of $7.3 million, garnering us more than $101 million in total equity to date. Capital remains a key component to our financial health as it is necessary to maintain adequate financial reserves for loan losses as our assets continue to grow. It ensures that we are able to withstand any uncertainty. A new risk-based capital requirement, which we have implemented, is required of us as a large complex credit union starting this year.

Our financial strength continues to be nationally recognized. Weiss Ratings, the nation’s leading independent provider of ratings and analyses of more than 19,000 financial institutions, including banks, credit unions, life and annuity insurers, and property and casualty insurers, gave us an “A” rating. A ranking of “A” is considered excellent, meaning SeaComm offers excellent financial security. SeaComm maintains a conservative stance in its business operations as evidenced by their strong equity base, superior asset quality, steady earnings and high liquidity. Weiss goes on to state that SeaComm has the resources necessary to deal with severe economic conditions. SeaComm is among an elite group of 660 credit unions nationwide representing the top 13% of the industry.

BauerFinancial, an independent rating company, recently awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality.

It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

DepositAccounts also gave us an A+ rating for FY21; one of the highest health grades given out and placing us in the top 200 healthiest credit unions in the U.S.

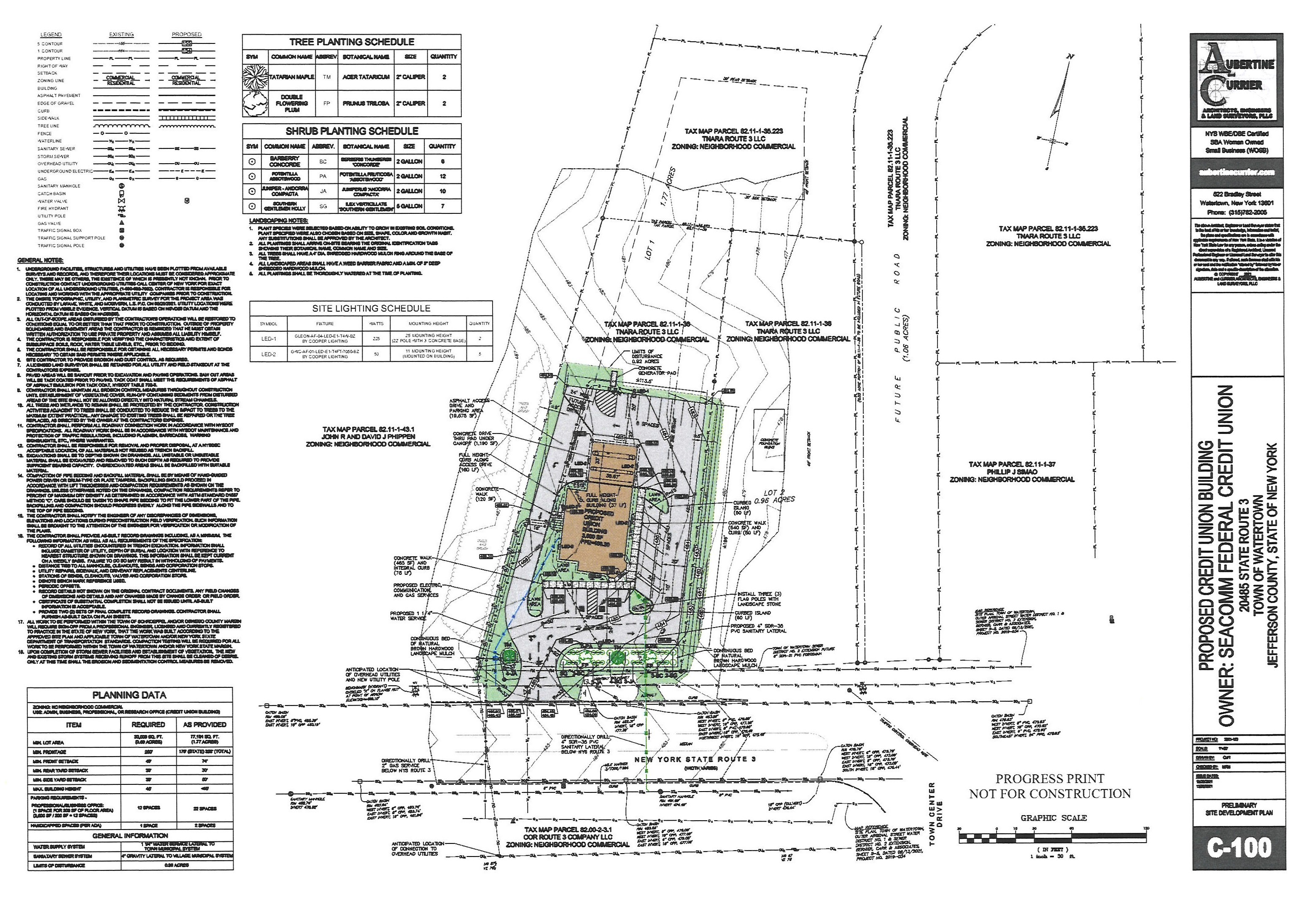

New Branch in Watertown

The Board of Directors has approved plans to move forward with the construction of our ninth retail branch in Watertown, NY. Since our merger with United Neighbors FCU there is a need to expand the services currently offered in this market. This new branch will offer the Credit Union opportunity to continue to grow and offer additional services, such as an ATM and drive-thru which is not available today at our Coffeen St. location. The new location would be on NYS Route 3 across from the Towne Center, which has a Target and Peto. It is expected that the groundbreaking will be held this May with a completion in early fall.

Even though we are growing into new markets, we are still committed to our intended mission; and will be forever committed to our roots of taking care of all our members. It all started nearly 59 years ago in that iconic tool box and our focus on the details will ensure we stay consistent with those humble beginnings.

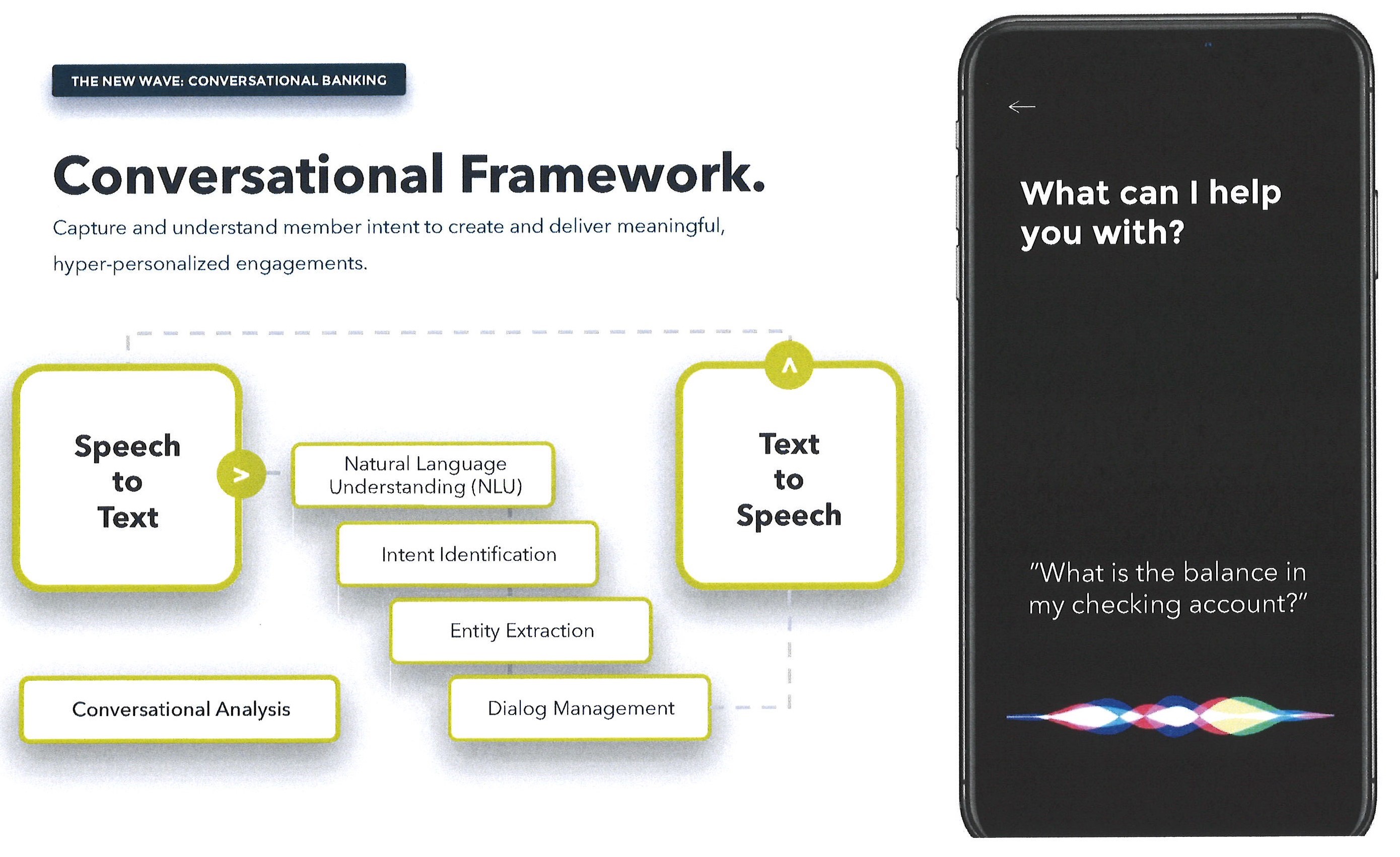

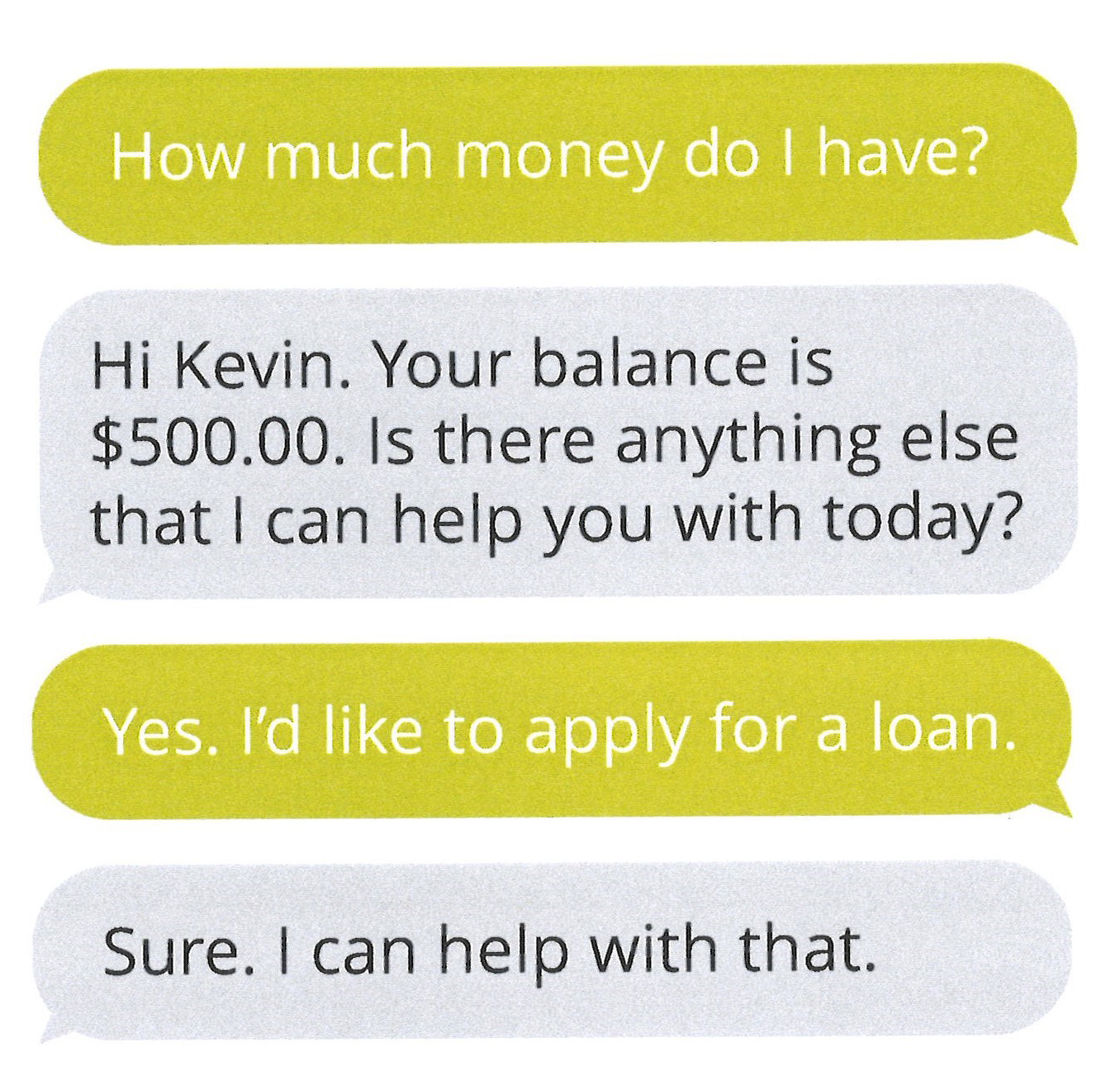

Smartline Enhanced

We are excited to enhance our self-serve Smartline. This delivery channel enables a member to do a number of different types of transactions 24/7. This now will be available as part of our Call Center, whereby a caller can interact using voice recognition to request a balance, transfer funds or pay a loan payment. This includes, on the phone, via SMS text and instant chat, 24 hours a day, seven days per week. We are putting this together to make it even more convenient for our membership to do business with us at the time of their choosing, day or night. This new enhancement is expected to be launched in the first half of this year.

Mobile Enhancements

We have also continued to enhance features on our mobile application. This includes resetting a password and unlocking an account. We have made a number of changes in this delivery channel over the course of the past year to continue to focus on self-serve and efficiency, which we heard loud and clear from our membership.

As we near a second full year into this unpresented time, and although there has been some change to our normal operating environment by adding to all precautionary safety protocols in place as advised by the NYS Department of Health and CDC, all of our staff are working and we are fully operational. This is the testament to our employees, who have been coming to work each day throughout the pandemic to ensure we continue to do what we do best, take care of our members.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 51,800 members, who continue to put their trust in us, and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Report of the President & Chief Executive Officer

As we move well into the third quarter, SeaComm continues to be on target to meet our expected forecast set forth in the FY21 operating budget. Member satisfaction, staff engagement and overall profitability continues to remain above expectation.

Our Financial Position Today Continues to Remain Solid

Net income as of July 31, 2021 is $3,170,623. Our net assets at the end of July were $731,438,341. At the same time, net operating expenses YTD were 1.55%, well below the 3% targeted goal set by the credit union’s budget. Today, we have $101 million in total equity to date. Capital remains a key component to our financial health, as it is necessary to grow adequate reserves so we are able to withstand any uncertainty as our assets continue to increase and thereby be viable well into the future.

Weiss, an independent rating agency, has once again provided SeaComm the A- rating in terms of excellent financial strength for Q1 FY21. This means that we offer excellent financial security. We have maintained a conservative stance in our business operations and underwriting practices as evidenced by the strong equity base, high asset quality, steady earnings, and high liquidity. The A- rating places this institution on Weiss Recommended List of institutions, an elite group of 566 credit unions representing the top 11.0% of the industry.

BauerFinancial, another independent rating company, awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements. DepositAccounts has also given us an A+ rating for Q1 FY21; one of the highest health grades given out.

Annual Meeting

In my report at this year’s annual meeting held in May, we were able to announce 2020, although a challenging year with COVID-19, was another solid year for SeaComm. Highlights for the previous year, which included: earnings exceeding budget, membership growth at 3 ½ percent, continued increase market share penetration with our newest location in South Burlington, VT, as well as a solid fifth year for our SeaComm Personal Advisor Services with over $50 million of assets under management. We also saw an increase in our mobile technology with a growth of 30%. We were also able to support our members early on during the economic pause as a direct result of the global pandemic. Those who needed assistance had nearly $20 million in total loan balances and we also were able to support our small businesses with $13 million in PPP. The overall message we relayed was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model at any point it is needed. Three Directors were re-elected to 3-year terms, Wayne Duso, Gary Fuller and Robert Santamoor. A podcast recapping the 2020 meeting is available on our website.

United Neighbors Merger Complete

Last year, the Board of Directors approved to move forward with a merger with United Neighbors Federal Credit Union of Watertown, NY. Their Board of Directors, as part of the due diligence process, and National Credit Union Administration (NCUA) regulation conducted a vote of their membership, which in turn gave approval to move it forward. The NCUA approved the merger and it was certified on May 14, 2021 with a letter from the Eastern Regional Director. The operational transition of all deposit accounts, loans and debit cards was completed on June 1.

As part of this merger, the SeaComm Board of Directors formed a Watertown Advisory Committee comprised of United Neighbors former board members. The charge of this committee is to gauge how the merger went (based upon what the UN board had expected), market knowledge and were the members satisfied with the transition. The committee is chaired by Corey Decillis, former Board President, Jeff Rutigliano and William Spauldling. We also were able to retain the dedicated staff of the credit union. Leslie Bush continued as the manager of our Watertown Branch.

In conjunction with this merger, the Board of Directors approved moving forward with a search and purchase of property and future construction of a new retail branch in the Watertown market. It is expected that construction will begin spring 2022. P.W. Campbell, Pittsburgh, PA will be the design/build firm.

Vermont Expansion

We recently finished the construction of our second Vermont location in Essex. We held a ribbon cutting in April and hired a new branch manager and staff. Although we are adding another new market for us to serve, we are committed to exceeding member expectation as we always have. It is important for every member to know that we make certain that everything we plan and ultimately implement has member and employee satisfaction as our end goal.

In an effort to be inclusive of all our employees, we made a decision to choose a new engagement survey to ensure that our Vermont employees were able to participate. For ten consecutive years, SeaComm has been a Best Company to Work for in New York. Our decision to go with Great Place to Work Certified enabled us to meet our needs. Earlier this year, our employees were able to participate in this new process. We were very happy to report that after we received the results, 89% of our employees say this SeaComm is a great place to work. Some of what we learned is that 97% felt good about the way we contribute to the community, 95% agree that management is competent at running the business and 95% say when you join the company, you are made to feel welcome. We are extremely proud to be included within this privileged group across the country.

As we look to the remainder of this year, we will be focusing our attention on enhancing our mobile platform and ensuring that every interaction with our membership exceeds expectation. This focus continues to meet the ever-changing business landscape and provide each member with a strong value proposition in being a member of our credit union. This is done through a consistent and responsible growth strategy.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 51,486 members who have put their trust in us and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Message from the President & Chief Executive Officer

Fifty thousand members and growing. We recently hit this significant milestone with a new member account opened in our Malone branch. How proud all of those who were part of the early days would be today. Earl Jackson, of Massena, who signed our original charter, stated, “Something I never dreamed about. We wanted to help a few people. It is amazing.” We continue to ensure we are focused on the mission of “People Helping People” even more than 57 years later. We have come a long way since the toolbox at the Chevrolet Plant. Gary Fuller, Secretary of the Board, who has been with the Credit Union since day one, said, “It is amazing how many people we have helped.”

Increasing our market share is a long-term strategic goal of the Credit Union. This past year as part of our ongoing strategy discussions, the Board of Directors unanimously approved plans to move forward with requesting a charter expansion from the National Credit Union Administration (NCUA) into Jefferson and Lewis Counties. Our Federal regulator NCUA had to give us approval to expand our existing charter. Therefore, we submitted a comprehensive application, business plan and marketing strategy with a three-year financial forecast to the Office of Credit Union Resources and Expansion.

We are happy to report that NCUA approved us to move forward with our plans adopting a new field of membership which encompasses all of Franklin, St. Lawrence, Clinton, Essex, Jefferson and Lewis Counties in New York and Grand Isle, Franklin and Chittenden Counties in Vermont. The Board of Directors adopted the amendment to our Charter on December 16, 2020.

In order to continue SeaComm’s success it is necessary to garner new members. Today, SeaComm has a significant market share penetration in its original field of membership. Our strategy is to continue to diversify the markets in which we do business. This diversification will enable SeaComm to withstand certain economic anomalies which have or could be market specific. Most recently, we opened a retail branch in South Burlington, VT and very soon in Essex, VT.

The Board of Directors, in their decision-making process, is committed to the fact that the exceptional member service our current members have come to expect will remain at the highest level as part of this planned expansion. SeaComm is also committed to staying true to our mission. In fact, to solidify that position, the Board, myself and the senior leadership team continue to make this part of our regular agenda for ongoing strategic planning discussions. As we move forward with more definitive plans, we will be making those available.

As we have been navigating a difficult world-wide pandemic that placed our economy in a holding pattern, we recognize even more the importance of ensuring we have sufficient net worth. Our retained earnings have continued to keep pace with our asset growth and have an excellent capital position. This expansion will enable our Credit Union to grow and be financially sustainable well into the future.

Even though we are growing and heading into these new markets, we are still committed to our intended mission; and will be forever committed to our roots of taking care of all our members. It all started more than fifty-seven years ago in that iconic tool box and our focus on the details will ensure we stay consistent with those humble beginnings.

Financial Strength:Our financial position continues to remain solid. Year-end assets climbed in excess of $660 million, an annual growth of 16% from year-end December 31, 2019. At the same time, our net operating expenses YTD were at 1.90%, well below our goal of 3%. We finished the year with a net income of $6 million, garnering us more than $99 million in total equity to date. Capital remains a key component to our financial health as it is necessary to maintain adequate reserves for loan losses as our assets continue to grow. It ensures that we are able to withstand any uncertainty like we are encountering today with COVID’s hit to our economy. A new capital requirement has been approved by the NCUA Board and will be fully implemented by January 1, 2022. We are prepared for these changes.

We acknowledge that our results also stem from effective margin and balance sheet management with a strong emphasis on expense control. We are constantly looking for ways to diversify. The more diversified our income stream, the more likely we can offset any adverse economic conditions that come our way. This also enables us to offer new products and services, which are geared for our members’ current needs.

Our financial strength continues to be nationally recognized. Weiss Ratings, the nation’s leading independent provider of ratings and analyses of more than 19,000 financial institutions, including banks, credit unions, life and annuity insurers, and property and casualty insurers, gave us an “A-” rating. A ranking of “A-” is considered excellent, meaning SeaComm offers excellent financial security. SeaComm maintains a conservative stance in its business operations as evidenced by their strong equity base, superior asset quality, steady earnings and high liquidity. Weiss goes on to state that SeaComm has the resources necessary to deal with severe economic conditions. SeaComm is among an elite group of 547 credit unions nationwide representing the top 10.5% of the industry.

BauerFinancial, an independent rating company, recently awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

Service & Our People a Key Focus:Our focus has been offering our members a compelling value. From the time they walk into one of our branches, phone into our Call Center or log in at one of our mobile delivery platforms, we want the experience to exceed their expectations. We don’t take that lightly. In fact, we obsess over it. We believe so much in member satisfaction, that on a monthly basis, random surveys are sent out to members who have conducted some sort of transaction at the Credit Union. This can be as simple as a balance inquiry to applying for a loan. Whatever the circumstance, we want feedback on how the member was treated and if we did everything necessary to make them feel valued. The survey results are reviewed by everyone on the management team that is responsible for the retail area, as well as by the senior leadership team and me.

If we do find areas where there needs to be improvement, we ensure that changes are made. The only way we can improve our delivery experience is if someone tells us where changes need to be made. This year, personally I will be engaging a number of member focus groups to hear directly about what they perceive as their experience in the branches.

At the end of each year, we calculate the overall average of every employee who received surveys on their delivery of service both externally and internally. The top ten in 2020:

- Melissa Cree, Core Support Specialist, Information Systems

- Aaron Hoyt, Systems Administrator II, Information Systems

- Tabitha Ladison, Team Lead, Payment Operations

- Noah McCarthy, Help Desk Specialist, Information Systems

- Rose Lapoint-Matthews, Senior Teller, Canton Branch

- Sarah Mitchell, Risk Manager

- Brooke Peck, Senior Teller, Malone Branch

- Jeffrey Reynolds, Financial Services Representative/IRA Specialist, Stearns St. Branch

- Taylor Thrasher, Call Center Representative

- Lisa Tyo, Call Center Representative III

All were recognized for their high achievement in this area. This is the eighth year in a row for Rose Lapoint-Matthews of our Canton Branch, who has been consistently at the top for exceptional service. We are extremely proud of those individuals and the work all of our employees perform and their consistency in delivering exceptional member service.

This year, for the first time, a branch was given an award for the top Quality Loop overall average. This is a new category and was awarded to Plattsburgh with an overall score of 6.86 out of 7. Congratulations to Yvonne Alterie, AVP Regional Manager/Branch Manager, and her entire team.

We know why SeaComm is so successful. We have a talented, smart, hard-working staff, which takes great pride in their work of serving our members. We do have high expectations and are committed to maintaining that standard, moreover, we are incredibly fortunate to have dedicated employees who live our service values.

New Services: We now have available instant issue credit. This new service will enable our members to come in, be approved for a credit card, and walk out with one the very same day. This will also assist our members who have had their cards compromised, so they do not have to wait 10 business days for a new one to arrive in the mail. We already have this on our debit card platform. We have also added some enhanced features on our mobile application. This includes a forgot password link, our routing & transit number for convenience, ability to turn a debit card on or off for security purposes, and a single sign-on feature to pay your payment.

Today, you can also apply for a mortgage online. In addition, we can virtually work through your process from the comfort of your own home.

Going forward, our focus continues to be on enhancing our product and service offerings to meet the ever-changing business landscape and provide each member with a strong value proposition in being a member of our Credit Union. This is done through a consistent and responsible growth strategy.

As we near a full year into this unprecedented time, and although there has been some change to our normal operating environment by adding to all precautionary safety protocols in place as advised by the NYS Department of Health and CDC, all of our staff are working and we are functioning smoothly. This is the testament to our employees, who have been coming to work each day to ensure we continue to do what we do best, take care of our members. And, finally, we have decided that no ScoreCard Reward points will expire in 2021, which will enable our members to use them as they choose, since most travel, for example, was on pause last year.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 50,000 members who have put their trust in us and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

CU Today Feature Article w/ Scott A. Wilson October 7, 2020

Report of the President & Chief Executive Officer

As we move well into the third quarter, we reflect on the fact that 2020 started out respectable with all indications that it would be a good year. Then we faced an unthinkable pandemic. Our economy has been slowed down considerably.

As a member of SeaComm it is important to know that our members can count on us to be there when they need us the most. Were we ready? The answer is yes. Overseen through our strategic planning process by our Board of Directors, it is important for everyone to know that SeaComm has been preparing for this event since 2008 when the global economic crisis hit the financial services industry and put our country into a great recession. SeaComm has grown over the past decade, including our capital reserves at just over $90 million or 14.29%. The National Credit Union Administration (NCUA), our Federal regulator, necessitates at least 7% of a credit union’s assets are to be reserved in order to be considered well-capitalized. We are more than twice that requirement. We stress test our liquidity and capital each quarter to ensure if some sort of economic anomaly like the one that is occurring today, positions us to weather it. Liquidity at the Credit Union is very strong. We have monthly cash flows, which enable us to operate, loan or invest. In addition, we have access to a line of credit at the Federal Home Loan Bank of NY or the Federal Discount Window at the Federal Reserve Bank, which we can utilize. That has not been necessary at this time. This is due to the financial strength of the Credit Union.

Throughout the last several months we were well equipped to meet the financial needs of our membership. We have been working daily with anyone who has been affected by layoffs, furloughs or impacted in anyway by this economic turmoil. We are always open to assisting members with a number of options, including, but not limited to, offering lines of credit, extensions or skip payments, bridge loans or even waiving a penalty for early withdrawal on a certificate of deposit. This includes our business members.

Through the US Treasury Stimulus, our small business members had been able to apply for Payroll Protection Program loans guaranteed by SBA. We have ensured that our member businesses had access to this program. Those were necessary for our small businesses and their respective employees. This kept so many working and helped to bridge them by underwriting nearly $6 million worth of loans through PPP. This was key component of the economic stimulus plan that the Treasury put into place to get us through this unprecedented time.

Although there has been some change to our normal operating environment, all of our staff were working during the shutdown and functioned smoothly. This is the testament to our employees, who have been coming to work each day to ensure we continue to do what we do best, take care of our members and their families. With that said, SeaComm continues to work toward meeting our forecast set forth in the FY20 operating budget. Member satisfaction, staff engagement and overall profitability continues to remain high. We will begin construction on the second of three planned branches in Vermont.

Our Financial Position Today Continues to Remain Solid: Year-to-date net income as of July 31, 2020 is $ $3,569,701. Our net assets at the end of the same period were $646,237,077. At the same time, net operating expenses YTD were 1.90%, well below the 3% targeted goal set by the credit union’s budget. Today, we have $90 million in total equity to date. As I had mentioned previously capital, remains a key component to our financial health, as it is necessary to grow adequate reserves in times like today where we can withstand uncertainty as our assets continue to increase and thereby be viable well into the future.

Weiss, an independent rating agency, has once again provided SeaComm the A- rating in terms of excellent financial strength. BauerFinancial has once again provided SeaComm with their Superior Five-Stars. This independent rating agency analyzes the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality.

It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements. DepositAccounts has also given us an A rating for Q1 FY20; one of the highest health grades given out.

It has deemed SeaComm as safe, financially sound, and that we are operating well above regulatory capital requirements. DepositAccounts has also given us an A rating for Q1 FY20; one of the highest health grades given out.

56th Annual Meeting: This is the first time in the history of SeaComm that we held our annual meeting virtually. This did afford us the opportunity to provide full access to our members who wanted to attend even in other markets like Plattsburgh and South Burlington. In my report at this year’s annual meeting in May, we were pleased to announce 2019 was another exceptional year for SeaComm. It was emphasized that our financial strength has enabled SeaComm to continue to provide the essential services to our members even as the economy was on hold. Highlights for the previous year included: continued market share penetration at 33% with 1.78% in Clinton County, membership growth at 4%, net income of $6.2 million, as well as a solid sixth year for our SeaComm Personal Advisor Services with $34 million of assets under management. The overall message was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model. Two Directors were re-elected to 3-year terms, Myron Burns and Mitch Marolf. A podcast recapping the meeting is available on our website.

In my report at this year’s annual meeting in May, we were pleased to announce 2019 was another exceptional year for SeaComm. It was emphasized that our financial strength has enabled SeaComm to continue to provide the essential services to our members even as the economy was on hold. Highlights for the previous year included: continued market share penetration at 33% with 1.78% in Clinton County, membership growth at 4%, net income of $6.2 million, as well as a solid sixth year for our SeaComm Personal Advisor Services with $34 million of assets under management. The overall message was that SeaComm is committed to ensuring our members get the very best in member service, core products and a diverse delivery channel model. Two Directors were re-elected to 3-year terms, Myron Burns and Mitch Marolf. A podcast recapping the meeting is available on our website.

Market Expansion: The Board of Directors has approved plans to move forward with the construction of our second branch in Essex, Vermont. This additional location will offer the Credit Union opportunity to continue to grow and diversify our markets in the state. It is expected that the groundbreaking will be held early September with a completion in early spring 2021.

As we have stated in the past, even though we are adding another branch, we are committed to exceeding member expectation as we always have. It is important to know that we make certain that everything we plan and ultimately implement has member and employee satisfaction as our end goal. Our focus has and continues to be to offer our members a compelling value. From the time they walk into one of our branches, phone into our Call Center, or log in at one of our mobile delivery platforms, we want the experience to exceed their expectations. We do not take that lightly. In fact, we obsess over it. We believe so much in member satisfaction, that on a monthly basis, random surveys are sent out to members who have conducted some sort of transaction at the Credit Union. This can be as simple as a balance inquiry to applying for a loan. Whatever the circumstance, we want feedback on how the member was treated and if we did everything necessary to make them feel valued. The survey results are reviewed by everyone on the management team that is responsible for a retail area, as well as by my senior leadership team and myself.

Earlier this year, we were notified that SeaComm had been chosen for a tenth consecutive year as one of the Best Companies to Work for in New York. Our selection as #13 out of 21 of the top mid-sized companies was based upon a survey in which our employees were asked to participate, along with requested criteria we had to provide. A few of the focus areas included role satisfaction, leadership & planning, work environment, corporate culture and communication as well as relationship with supervisor. In response to the question, Overall, I am very satisfied with my employer, we received 96% agreement. We are extremely proud to be included within this privileged group.

Governmental Affairs: SeaComm’s involvement in the credit union movement goes beyond our geographic market of the North Country. Each year, members of our Board of Directors, senior staff and myself travel to Washington, D.C., to talk with key legislators about issues which are extremely important to the credit union industry. Our visit to Washington in late February, also included a visit to the Hill with our representatives in Vermont as well as the 21st New York Congressional District Representative Elise Stefanik. The Congresswoman has been supportive of legislation which would benefit credit unions,including, H.R. 225 Stopping Merchant Data Breaches (which would require merchants to face the same strict data security that financial institutions are subject to under the Gramm Leach Bliley Act), as well as H.R. 1941/S.774 and the “Financial Institution Examination Fairness and Reform Act”. In addition, she supports the continuedprotection of the credit union tax exemption status. She has also applauded credit unions for the efforts we play in the creation of jobs through small business lending.

We are also actively involved in our national trade organization National Association of Federally-Insured Credit Unions, where I have been privileged to be a member of the NAFCU Board’s nominating committee for the past five years.

Going forward our focus continues to be on enhancing our product and service offerings to meet the ever-changing business landscape and provide each member with a strong value proposition in being a member of our Credit Union. This is done through a consistent and responsible growth strategy.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 49,100 members who have put their trust in us and we will continue to work diligently to remain strong in order to be able to serve well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

Message from the President & Chief Executive Officer

Market diversification continues to be a long-term strategic goal of the Credit Union and one that has been emphasized by our Board of Directors for the approval for expansion into Vermont. This January we made strides to continue to meet this goal when we opened our first of three retail branches in South Burlington, VT. You can read more about it on page two of this publication. We are in the planning stages for our second branch in Essex, VT for this fall. Our third location will be in 2021 in St. Albans, VT. In order to continue SeaComm’s success, it is necessary to garner new members.

Today, SeaComm has a significant market share penetration in its current field of membership. New opportunity in a region which has been economically flat will over time make growth a challenge. Our strategy is to continue to diversify the markets in which we do business. This diversification will enable SeaComm to withstand certain economic anomalies which have or could be market specific. Our retail branch in Plattsburgh, NY, is continuing to grow and, after more than two years in operation, has proven to be an excellent location.

The Board of Directors in their decision-making process is committed to the fact that the exceptional member service our current members have come to expect will remain at the highest level as part of this planned expansion. SeaComm is also committed to staying true to our mission. In fact, to solidify that position, the Board, myself and the senior leadership team continue to make this part of our regular agenda for ongoing strategic planning discussions.

The Credit Union continues to be positioned for growth. Our retained earnings have continued to keep pace with our asset growth and we have an excellent capital position. This expansion will enable our Credit Union to grow and be financially sustainable well into the future.

Even though we are heading into new markets, we are still committed to our intended mission; and will be forever committed to our roots of taking care of all our members. It all started fifty-seven years ago in that iconic toolbox, and our focus on the details will ensure we stay consistent with those humble beginnings.

Financial Strength

Our financial position continues to remain solid. Year-end assets climbed in excess of $570 million, an annual growth of 4% year-to-date. At the same time, our net operating expenses YTD were at 2.12%, well below our goal of 3%. We finished the year with a net income of $6.2 million, garnering us more than $89 million in total equity. Capital remains a key component to our financial health, as it is necessary to maintain adequate reserves as our assets continue to grow. It ensures that we are able to withstand any uncertainty such as we encountered during the earlier part of the last decade. A new capital requirement has been approved by the NCUA Board and will be fully implemented by January 1, 2022. We are well positioned for that change.

We acknowledge that our excellent results also stem from effective margin and balance sheet management with a strong emphasis on expense control. We are constantly looking for ways to diversify our non-interest income streams as well. Our Personal Financial Advisor Services, which are available to any SeaComm member, continues to grow. Today, more than $37 million are under management.

Our financial strength continues to be nationally recognized. BauerFinancial, an independent rating company recently awarded us their Superior Five-Stars. They analyze the performance of U.S. Banks and Credit Unions. The star ratings classify each credit union based upon a complex formula which factors in relevant data including, but not limited to: capital, historical trends, loan delinquencies, differences in the book and market values of the investment portfolio, profitability, repossessed assets, reserves, charge-offs, regulatory compliance and asset quality. It has deemed SeaComm as safe, financially sound and we are operating well above their regulatory capital requirements.

Service & Our People a Key Focus

Our focus has been offering our members a compelling value. From the time they walk into one of our branches, phone into our Call Center or log in at one of our mobile delivery platforms, we want the experience to exceed their expectations. We do not take that lightly. In fact, we obsess over it. We believe so much in member satisfaction, that on a monthly basis, random surveys are sent out to members who have conducted some sort of transaction at the Credit Union. This can be as simple as a balance inquiry to applying for a loan. Whatever the circumstance, we want feedback on how the member was treated and if we did everything necessary to make them feel valued. The survey results are reviewed by everyone on the management team that is responsible for the retail area, as well as by the senior leadership team and me. If we do find areas where there needs to be improvement, we ensure that changes are made. The only way we can improve our delivery experience is if someone tells us where changes need to happen.

At the end of each year, we calculate the overall average of every employee who received surveys on their delivery of service both externally and internally.

The top ten were Jeff Reynolds (2 consecutive years), Wanda Lanning, Rose Lapoint-Matthews (7 consecutive years), Erica Horan and Laurie French, Kim Holloway (2 consecutive years), Melissa Cree (3 consecutive years), Tab Ladison (3 consecutive years), Wendy Vatter (3 consecutive years) and Kathy Dunkleberg were recognized for their high achievement in this area. We are extremely proud of those individuals and the work all of our employees perform and their consistency in delivering exceptional member service.

We know why SeaComm is so successful. We have a talented, smart, hard-working staff, which take great pride in their work of serving our members. We do have high expectations and are committed to maintaining that standard, moreover, we are incredibly fortunate to have dedicated employees who live our mission of “people helping people”.

In mid-January, we received notification that we had been chosen for a tenth year in a row as one of the Best Companies to Work for in New York for 2020. Our selection as one of the top mid-sized companies is based upon a confidential written survey in which our employees were asked to participate, along with requested criteria we had to provide. A few of the focus areas included role satisfaction, leadership and planning, work environment, corporate culture and communication, as well as relationship with supervisor. We are extremely proud to be included within this privileged group.

Community Service

We do a tremendous amount for the communities in which we do business. Direct financial support and giving of our time through our “Do Some Good” program. The senior leadership team and myself make ourselves available twice a year to assist our local “Back the Pack” program, which during the school year offer snacks to tide students through the weekend. We are very proud to be a part of such a wonderful and important mission-driven organization.

On behalf of the Board of Directors, management and staff, we are grateful to our more than 48,500 members who have put their trust in us and we will continue to work diligently to remain strong in order to be able to serve you well into the future.

Respectfully submitted,

Scott A. Wilson

President and Chief Executive Officer

SeaComm Federal Credit Union President/CEO Scott Wilson stopped by the Studio Lounge to discuss is "CEO of the Year" award (credit unions $250 million and up) presented at NAFCU's 51st Annual. Scott shared some of the reasons why he believed he won the award -- and, in typical credit union fashion, none of them had to do with him. He had heaps of praise for his team at SeaComm in helping him garner this award along with making his credit union a huge success for their members.

Watch his video interview with NAFCU as he discusses his 'CEO of the Year' award.

Read the CEO/CFO Magazine interview with SeaComm President & CEO, Scott A. Wilson.